Geopolitical tensions, natural disasters, and the highest inflation rate in over thirty years are all contributing to the current pressures faced by the retail industry in Australia.

Consumers are tightening their wallets, major retailers are locking their prices, and suppliers juggling rising cost of wages and goods, and the industry overall is suffering the effects of ongoing volatility and supply chain disruptions.

With the economic climate as mercurial as ever, this raises concerns about the sustainability of current commercial strategies over the long-term.

Cost of Living Crisis

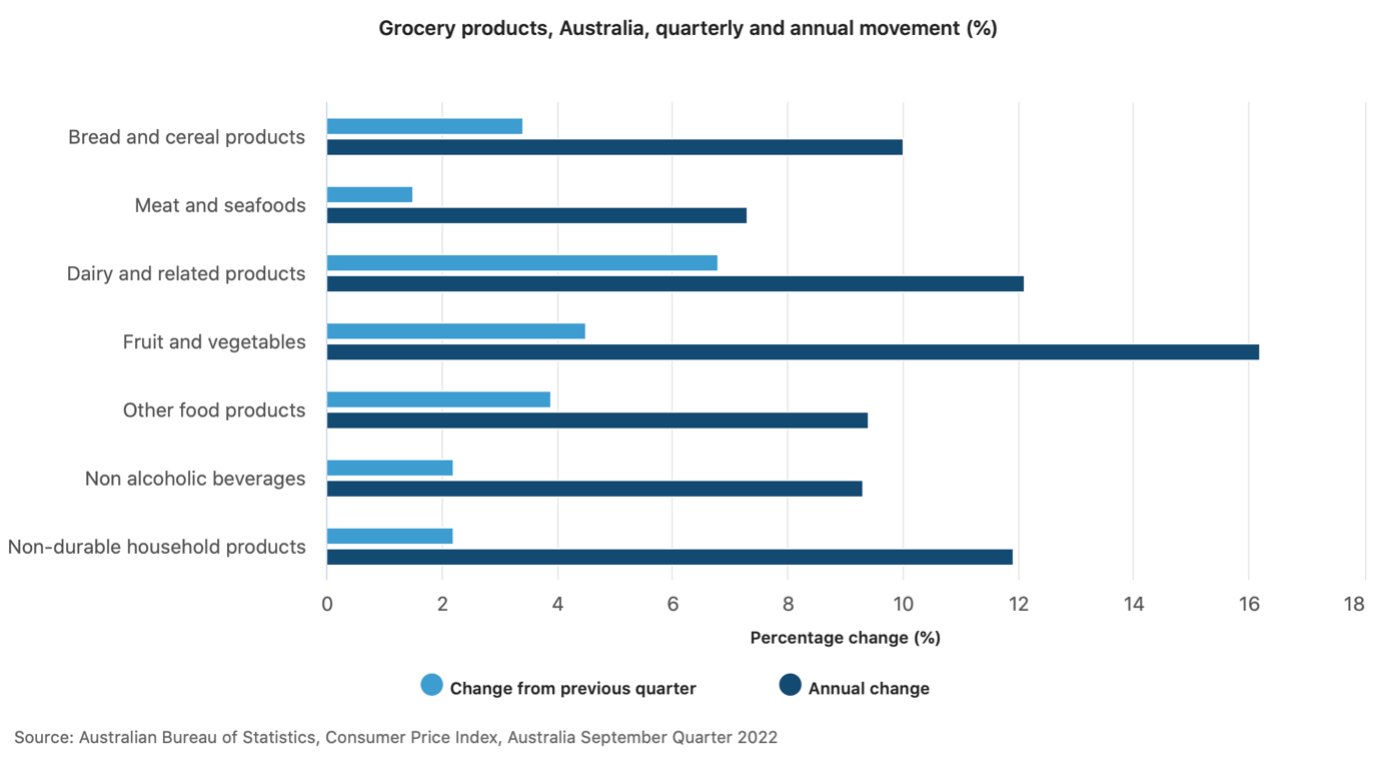

Food prices have skyrocketed since the beginning of the pandemic, September Quarter 2022 data shown in the graph below shows the steep rise:

“Over the twelve months the Food and non-alcoholic beverages group rose 9.6% in September. The increases are driven by Fruit and vegetables (+17.4%) and Meat and seafoods (+7.6%), due to flooding in key growing areas and higher input costs for freight and fertilizer.”

Packaged grocery inflation is at 4.3 per cent compared with a 25-year average of 1.1 per cent.

Within this rapidly shifting landscape, ALDI reports that 98% of the shoppers surveyed noticed an increase in overall grocery shop prices compared to previous years. 51% said they are concerned about the rising costs.

A survey of almost 4000 Coles customers found 85% said they’ve made changes to their grocery shopping to counter increased cost of living expenses, two-thirds are looking for more discounts.

Another recent survey, conducted by comparethemarket.com found Australians are searching harder for discounts, switching to home brands, and purchasing more frozen foods.

Discounters Maintain Price Promises

This seemingly bodes well for brands such as Aldi, as their business model thrives off providing ‘the best quality at the lowest price’.

But how will inflation impact discounters who already offer lower prices and aim to stay 15-25 percent more affordable than major supermarkets?

Woolworths and Coles supermarkets have locked their prices over the last quarter to allure customers in the lead up to Christmas but this raises the question of sustainability over the long-term.

Aldi’s Adrian Christie, director of customer interactions, informs the Australian Financial Review “Australians can be assured that every aspect of Aldi was built to minimise inflationary pressure and pass on as little cost to customers as possible.”

In their 2022 price report Aldi maintains they are 15.6% cheaper than the competition and can save buyers from $1,555 a year if compared with home brand products in major retailers and even more if compared to brand name products.

Innovative Operations

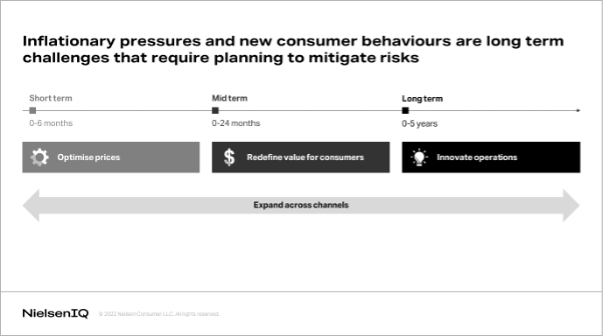

“To mitigate the risks rising from these pressures while retaining consumers and protecting profit margins, retailers and manufacturers need to take holistic approaches across price, product, communication, operational innovation, and channel expansion.”

Discounters’ streamlined supply chain structures and omni-channel marketing strategies could be some of the ways they remain progressively profitable during the downturn of the global financial market.

Discounters such as Aldi are known to be disruptively innovative, so we wait with bated breath as we see what their next move will be as they too weather the challenges faced within the current economic storm.